Since 2005, Rupli along with his wife, Linda, have actually added 220,349 right to lawmakers in Washington. Throughout that time, Rupli received 4.9 million in lobbying fees through the economic services relationship, based on disclosure that is lobbying.

States of Influence

Payday lenders additionally add millions to prospects in state elections, making them among the list of dozen or more top donors whenever numbers for state and federal campaign contributions are added together. That places them in identical ballpark that is influential by way of example, as unions, the video video video gaming industry and property passions.

In Wisconsin alone, efforts to ascertain mortgage loan roof of 36 per cent mobilized at the very least 27 registered lobbyists against it. On Feb. 16, Wisconsin lawmakers adopted a bill that may induce legislation of payday lenders for the first-time, although not before rejecting the attention price limitation. The debate garnered a lot more than the typical general public attention whenever their state assembly’s speaker acknowledged having an enchanting relationship by having a payday industry lobbyist. The industry spent 30 million in 2008 campaigning for ballot initiatives that would have wiped out laws curtailing payday lending operations in Arizona and Ohio. In comparison, reform teams reported investing just 475,000.

Even though the industry does not always win, “there’s not a way you are able to outspend them,” said Jennifer J. Johnson, senior legislative counsel towards the Center for Responsible Lending, a prime nemesis for the payday lenders.

The industry argues that more oversight — especially from Washington — is not necessary. One of the most trade that is active making the actual situation is Hackensack, N.J.-based Financial Service Centers of America, or FiSCA. “Financial solution facilities had  simply no role within the nation’s financial meltdown,” said Joe Coleman, chairman for the team, which represents 50 % of the nation’s purveyors of check cashing, cash transfers, money instructions, bill re re re payments and tiny buck, short-term loans.

simply no role within the nation’s financial meltdown,” said Joe Coleman, chairman for the team, which represents 50 % of the nation’s purveyors of check cashing, cash transfers, money instructions, bill re re re payments and tiny buck, short-term loans.

In fact, payday loan providers contend their solutions are essential now as part of your. “Who’s likely to make that types of credit offered to working people besides us?” asked Schlein, the spokesman when it comes to other trade that is major, the Community Financial solutions Association. The industry’s critics, whom consist of a few state lawyers basic, state that the industry buries way too many individuals in financial obligation. Significant limitations and policing of the industry are long overdue, they argue.

“Payday financing is similar to requiring a life preserver being in the front of an anvil,” said North Carolina attorney general Roy Cooper, a legislator that is former worked to eradicate major payday lenders from their state and succeeded in 2006.

Even yet in states which have effectively imposed restrictions on payday loan providers, the ongoing businesses often find inventive methods all over guidelines. State and federal agencies usually lack clear and constant authority; in a few states, loan providers have actually taken care of immediately tougher laws by going operations to tribal lands or on the online.

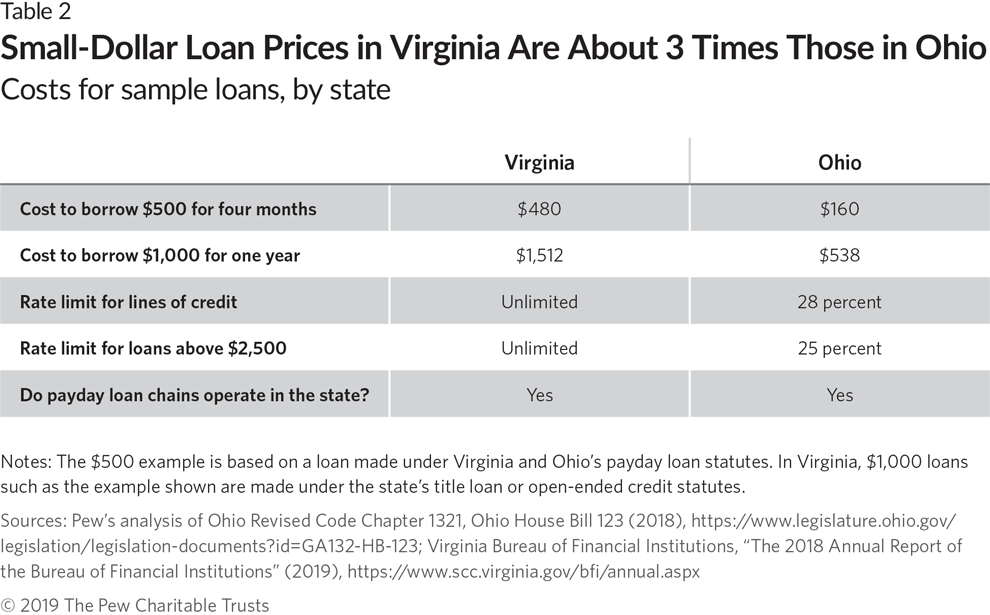

After Virginia’s legislature attempted to limit charges in ’09, loan providers switched to making car-title loans, with cars as security. In Ohio, payday lenders work around an innovative new 28 % price limit by invoking two older guidelines regulating installment loans that may actually allow greater prices. In Colorado, some lenders have actually skirted limitations regarding the quantity of consecutive loans they are able to make to a client with the addition of periods that are five-day loans.

Final October, Colorado ended up being the website of a market meeting targeted at mobilizing a huge selection of businesses focusing on supplying access that is rapid money through payday advances along with other services. The conference during the luxurious Broadmoor resort, sitting on 3,000 acres of tennis courses and forest that is rolling the root of the Rockies, ended up being sponsored by the trade team FiSCA.

PowerPoint presentations, handouts, and interviews with individuals suggest a market that keeps growing more methodical and anxious in countering threats to its business design. Highlighted presentations included topics such as for instance, “Organizing a Grassroots Effort.” One PowerPoint underscored the wider variety of techniques had a need to defeat the industry’s enemies. Stated the fall: “The times of simply lobbying are forever gone.”

Another slip, from the presentation by Kevin B. Kimble, a vice president of money America, the nation’s largest supplier of pawn loans, and William Sellery Jr., a premier FiSCA lobbyist, warned: “Payday lending now in play.” They characterized the industry’s strategic response being an “aggressive, multi-pronged defense” of payday financing, including not merely conventional way of impact but development of companies this kind of “Coalition for Financial Selection” to counter the image of payday lenders as debt traps. The group’s internet site, defines economic services as a “fundamental right” and urges supporters to by themselves as “pro consumer choice.”